Solvent Protocol’s mission is to make buying, trading and selling NFTs easier than ever before. It is the first liquidity platform for NFTs on Solana, giving traders the ability to deposit their NFTs in exchange for instant liquidity, in the form of fungible tokens called droplets, which can then be used to trade, stake and act as a fungible token.

NFTs currently are illiquid, and the primary ways they can be traded are via sale-based or auction-based marketplaces which are inefficient in terms of pricing discovery.

By launching its liquidity platform, Solvent Protocol aims to solve that problem, unlocking the issue of liquidity with NFTs for traders, and ensuring traders have access to instant liquidity on their assets.

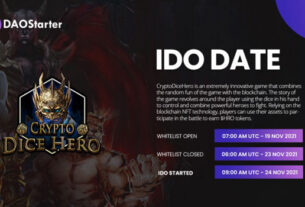

Whitelist registration will start at 7 Dec. at here

What is $SVT and what are the token utilities?

$SVT is Solvent Protocol’s governance token. It will be used by the DAO to vote on a variety of proposals related to Solvent Protocol.

$SVT will also be used for token staking, allowing Liquidity Providers to stake their $SVT tokens to gain benefits. These benefits include:

- A portion of fees charged by the platform will be used to open market buyback of $SVT tokens, which will then be distributed amongst token holders.

- On the basis of the amount of $SVT that is staked, users will get reduced minting fees to use the platform.

Previous Investments

Previous investments in Solvent Protocol have raised $1.8 million, and include the following:

- Seed investments at $0.1 per token, with a 5 month cliff. 10% of these tokens were unlocked at the Token Generation Event, with 10% unlocked every alternating month after the cliff. This brought us to a valuation of $10 million.

- Strategic investments at $0.18 per token with a 3 month cliff. 12% of these tokens were unlocked at the Token Generation Event with 11% every alternating month after the cliff, bringing us to a valuation of $18 million.

About Solvent Protocol

Solvent Protocol is a platform to convert NFTs to fungible tokens known as droplets, giving the user instant liquidity. This instant liquidity for NFTs provides users with a platform to trade NFTs faster than they can today.

Droplets can be traded on AMMs and Serum orderbooks on Solana. Users can trade droplets to redeem NFTs in Solvent buckets or swap droplets for $USDC directly from the platform. They can also stake droplets in liquidity pools and earn liquidity rewards. More features, like lending, loans, NFT derivatives, and other exciting integrations are to be released soon.

Liquidity is essential for enabling smoother transactions on any tradable asset. NFTs are highly illiquid today. One of the most common ways of trading NFTs today is via a sale-based or auction-based mechanism where the sellers list their NFT assets on marketplaces. In the sale-based mechanism, the sellers list their items at a fixed price, and buyers can pay that amount to receive the NFT asset to make a trade possible. In the auction-based mechanism, the sellers list their items for an auction and receive bids from the interested buyers, with the NFT asset going to the highest bidder. In both cases, the amount of capital that has to come into play just for executing one single NFT trade is high, and therefore the capital efficiency in both cases is low.

Advantages for the user to choose Solvent for liquidity are:

- Instant price discovery — If the users choose to list their NFT on marketplaces, they are required to select a price at which to list the asset, whereas Solvent can provide an instant quote on the price they’ll receive in exchange for depositing their NFT.

- Instant liquidity — Solvent can provide instant liquidity to NFT depositors once they deposit their NFTs, whereas, in the case of other marketplaces, the seller has to wait for the buyer to actually pay the amount and buy it from them, in order for the seller to receive the liquidity.

How are the funds of the IDO going to be used?

All the proceeds from the sale from $SVT will be used for the following:

- To kickstart liquidity pools for future buckets on Solvent Protocol platforms, so as to provide a seamless process for traders.

- To expand the Solvent Protocol team, so as to achieve quicker progress towards the goals that are highlighted in the Solvent Protocol roadmap (see below).

Roadmap

The immediate for Solvent Protocol in its roadmap are as follows:

Q1 2022

Integrating with Oracle for NFT floor price index feeds

We want to create real-time feeds and quotes for changes in the price of droplets by integrating Oracles on-chain. Each droplet represents one-hundredth of an NFT asset in any NFT project, and, as such, we can compute the floor price of an NFT project on Solvent in terms of USDC at any given time by multiplying the real-time price of the droplet for that project.

This integration will allow developers and other Web3 protocols to leverage real-time feeds from the oracle in order to build protocols and applications that utilize a stable AMM-based floor price feed on top of Solvent.

Releasing the Solvent SDK

We will be releasing the Solvent Javascript SDK publicly for developers and protocols to query Solvent bucket data and integrate Solvent’s functionality of tokenizing NFTs into droplets directly on their apps.

Q2 2022

Integration with Ethereum NFT projects

We will onboard Ethereum NFTs to Solana programmatically via cross-chain bridges and enable features of the Solvent platform for these Ethereum NFTs as well.

Integration with perpetual swaps protocol on Solana

We will use the Oracle-based pricing feed of droplets to trade floor perpetual swaps of the floor price on NFT projects.

Solvent Information

Website: https://solvent.xyz/

Twitter: https://twitter.com/solventprotocol

Discord: https://discord.gg/XtfdtQgf6p

Telegram: https://t.me/solventannouncements