Escrow Protocol has selected the FantomStarter.io app as their launchpad for their IDO, which will take place from the 22nd to the 24th of December, 2021.

Important Reminder:

All investments are paid in USDC on the Fantom network and claimed on the FantomStarter app. If you are not interacting with the FantomStarter app during the funding phase then it’s a scam.

Users need to complete KYC with Fractal.id as soon as possible to participate in the event. Only the whitelisted addresses will be able to participate.

- Complete KYC as soon as possible here.

- Click here to find out how to move USDC over to Fantom.

- Learn about the FantomStarter Tiers and NTF Keys here.

Summary:

- IDO Whitelisting and Pool Overview

- Introducing Escrow Protocol

- Product

- Platform Expansion

- Step-By-Step

IDO Whitelisting and Pool Overview

IDO Details: Public Pool

- Whitelisting starts: December 12, 2021

- Whitelisting closes: December 22, 2021

- Investment starts: December 22, 2021

- Investment closes: December 24, 2021

- Funding cap: $250.000

- Token price: 0.05

- Tokens for Sale: 5.000.000,00

- Payment Accepted: USDC

- Vesting: Claim 100% on December 27, 2021

FCFS Pool:

- Investment starts: After December 22, 2021

- Tokens for Sale: Leftover from the public sale.

Token Metrics:

- Seed: $110K total raise @ $0.00333 | 5% TGE — Weekly release over 12 months

- Private: $1.1M total raise @ $0.02 | 10% TGE — Weekly release over 12 months

- Private II: $192K total raise @ $0.035 | 20% TGE — Weekly release over 12 months

Introducing Escrow Protocol

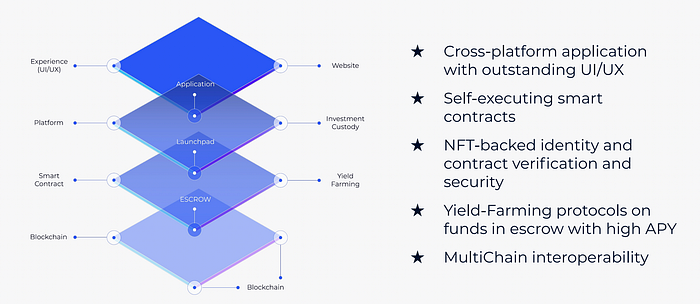

Escrow Protocol is a decentralized trust fund that combines traditional crowdfunding with Blockchain technology and easy-to-engage smart contracts.

Start-up projects seeking funding can lay out roadmap milestones and timelines according to their actual capacity and contingent upon realistic performance targets, establishing measurable criteria for delivering payments upon only fulfillable promises.

The process is articulated around a smart usage of NFT, DeFi, and tiered chat to provide an environment safe on investment, rug-pull free, and anti-scam.

Current landscape:

Investing in the private and public phases of crypto projects is a great opportunity for investors. There has been much improvement in how funds are raised starting with ICOs, IEOs, and even now IDOs.

Unlike traditional IPOs, the investor does not own an actual part of the company in the form of shares. This leaves crypto investors powerless to affect change or guide the roadmap, vision, or lack thereof.

The natural next step for early-stage investment is Escrow Protocol, an IDO platform with governance hardwired into the deployment of funds and ultimately the management of the project.

The Vision:

Escrow Protocol is working towards establishing a new safer standard for crypto investing and funding management. While waiting for payout on a milestone release, Escrow held funds are allocated to stable coin Yield Farming protocols where 80% of generated interest payments are returned to the investor. This means that funds are actively appreciated while waiting to be used in the project’s upcoming developments.

Product:

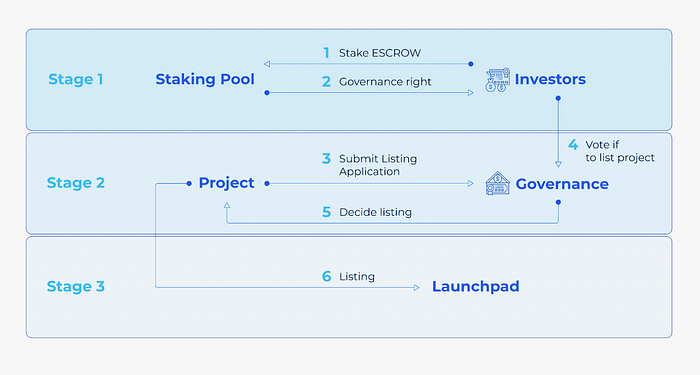

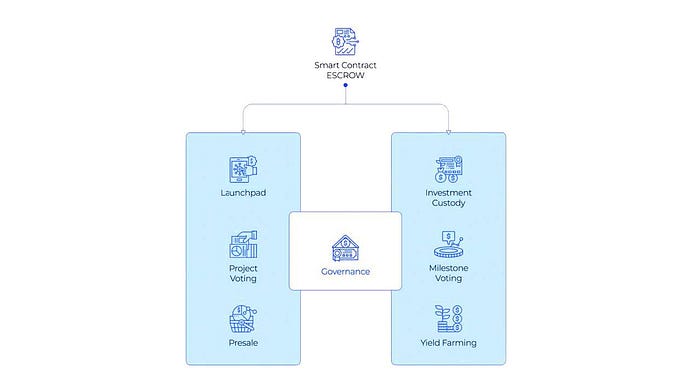

Its DAO investment platform releases raised funds in a prearranged payout based on successful milestone completion.

Utility:

- ESCROW Tokens are required to be staked to participate in the Private Rounds of hosted projects and to give weighted voting powers to investors.

- Minting NFTs are delivered via API in real-time based on KYC Results. They store contractual agreements between investors and projects. (Vesting Terms, Price) The NFT also acts as an access card to the platform and various tier chats.

Community Governance:

The community invests ESCROW into specific projects and is granted governance voting power over aspects of the project. Funds are held in escrow and released in Milestone-based payouts.

The weight of governance commensurates with the amount of ESCROW they have locked into the staking pool. The investor governance pool gives weighted voting power to influence funding decisions.

Yield-Farming & NFT:

Each project on the platform mints a set of NFTs which act as user ID Access Cards as part of the “know your customer” (KYC) process. NFT Access Badges are given and act as ID Cards for accessing project & investor exclusive information held within tiered chat rooms where the community can access project exclusive conversation.

Escrow-held investment funds are automatically allocated to best performing Yield-Farming protocols while waiting for payout. Investors passively earn high API returns on their investments in escrow by taking advantage of our Yield Farming Protocols Funds held in escrow beyond one year see gains of 25% or more.

MultiChain Interoperability

The Escrow Protocol is a MultiChain compatible platform that allows investors to safely invest using the cryptocurrency of their choice. Investors in Escrow Protocol have the option to invest via multiple major cryptocurrencies, such as bitcoin (BTC) and Ethereum (ETH), stable coins like USDT, and any future Escrow partner token. The Escrow Protocol interacts with these cryptocurrencies and their mainnet, allowing for funds to be locked and safely stored in smart contracts.

Platform Expansion

Once the ecosystem is firmly established comprising its various communities, Escrow Protocol will become a DeFi funding platform that promotes investment with community control. Ownership, control, and governance over the entire protocol will be decentralized and passed along to the community.

Investor Education

Reliable information about ICOs, their market areas, and their myriad of moving parts are difficult to come by, and there exists no comprehensive resource for investor due diligence. The Escrow Protocol platform has firm plans in place to expand its services in due course to offer a full investment education package, drawn from expert research and bolstered by the experience and knowledge gathered as the platform scales up and matures.

Anti-Bot Systems

Escrow Protocol plans to develop a robust anti-bot system that monitors all newly launched tokens, to protect the community from pump and dumps, gas manipulation, and other scams. These measures would effectively block pumps and dumps from the Escrow Protocol platform, and reduce the workload on the investigation community and the DevSecOps team.

Complete Roadmap:

Check Escrow Protocol’s complete roadmap to ICO launch, seed funding round opens offering, ICO sales and Marketing, new ICOs, upcoming ICO list, and much more.

ADVISORS:

- Latitude | Latitude Services is a top-tier company specialized in advising crypto projects and providing blockchain services.

- Bproto | Bproto is a development and consulting company dedicated to helping projects launch by leveraging the innovative Butterfly NFT domain technology.

Company & Team:

- ESW-PROTOCOL, LDA is a Company registered in Portugal, a country that offers clear and favorable regulations on cryptocurrency investments.

- CEO — Dennis Schulte: “We will establish the ESCROW PROTOCOL as a standard instrument for managing investments in crypto and crowdfunding projects.

- CTO — Guillaume Coco Provent: “My main motivation is to empower people, and provide them the best access to technology possible. Since 2016 I have been growing my Network in this industry and it’s now my time to give back.”

- Marina Silva | Marina Silva is the company’s cryptocurrency specialty lawyer and is the current seated President of the Portuguese Association of Digital Law.

Tags:

#antiscam #investmenthub #secureinvestments

Links:

🌐 Website/App

📖 Pitch Deck

📄 White Paper

💬 Telegram Group

💬 Twitter

💬 Medium

Step-By-Step

Step 1: Complete KYC

First, you will need to KYC with Fractal.id. If you need help we have posted step-by-step and Troubleshooting KYC guides to help you complete the process. Make sure you read the F.A.Q.

Note: KYC is completed -> KYC Approved -> One-click Whitelisting

Step 2: Whitelist

Once your KYC is completed, whitelisting will start on December 12, 2021, at 17:00 UTC and will end on December 22, 2021, at 16:00 UTC.

Step 3: Invest

The investment phase for users whitelisted in the Public and Private pools begins December 22. Learn how to bridge funds over to Fantom network here.

Step 4: Claim Tokens

Date claim tokens: December 27

Step 5: Listing

Listing details to follow.

Follow us

We have loads of exciting updates coming. Follow us using these channels so you can stay up to date:

Website: https://fantomstarter.io/

Main Telegram: https://t.me/fantomstarter

Announcement Telegram: https://t.me/fantomstarterannouncement

Trading Telegram: https://t.me/fantomstartertrading

Medium: https://medium.com/@fantomstarter

Twitter: https://twitter.com/fantomstarter

Inquiries: hello@fantomstarter.io

Reddit: https://www.reddit.com/r/FantomStarter/

https://discord.com/invite/nsMxVcNwy6