LunaPad Ido

Pandora whitelist competition

There will be a total of 100 people who will receive the right to purchase 200 usd per person

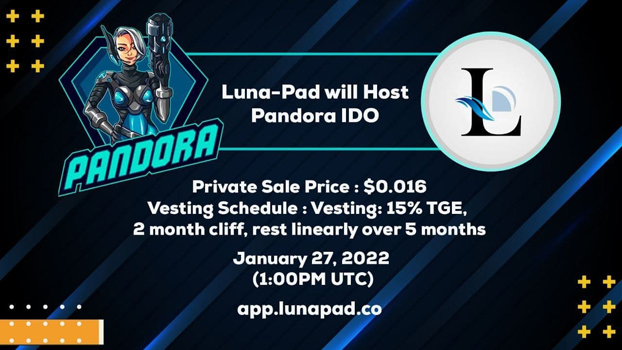

🔥 Luna-Pad will Host Pandora IDO on January 27, 2022 (1:00PM UTC)

IDO Information:

IDO Price : 0.0160 USD

Amount of Tokens : 6,250,000 DORA

Amount to Raise : 100,000 BUSD

Listing Date : 27 January post IDO

Listing Exchange : PCS

Listing Price : 0.0160 USD

Initial Market Cap : $550,000

Click here to register

🛑 Vesting: 15% TGE, 2 month cliff, rest linearly over 5 months<br />

Token Name : DORA

Symbol : $DORA

Total Supply : 2,500,000,000